Why Are There So Many Cryptocurrencies?

Over 20,000 cryptocurrencies exist today. Most are dead. Many never lived. Here's why they keep showing up—and why the FBI just launched a fake token to catch the manipulators.

TL;DR

- •17,000+ actively traded cryptocurrencies exist, but estimates count 37+ million unique tokens ever created (most inactive/worthless). Creating a token is easier than incorporating - Ethereum's ERC-20 standard lets anyone deploy in minutes with minimal coding.

- •Tokens function as dual-purpose instruments: fundraising shortcut + hype engine + community magnet, bypassing traditional finance regulation. They're also programmable status - granting governance rights, in-game perks, metaverse access, blurring equity/currency/internet culture.

- •FBI's Operation Token Mirrors created fake token 'NextFundAI' to catch manipulators. Result: $25M seized, 18 indicted, wash-trading firms (Gotbit, CLS Global, ZM Quant) shut down. DOJ treated schemes as securities fraud, not innovation. Four already pleaded guilty.

- •Market makers weren't amateurs - they ran dashboards for daily wash volume targets, trading bots simulating natural volume, wallet networks hiding self-trades, coordinating across BitMart/LBank/XT.com. At least 60 tokens manipulated. 'We have to make [buyers] lose money in order to make profit' - caught on record.

No agenda. No noise. Just clarity.

Get the MCMS brief - digital assets, AI, and law explained with evidence, not hype.

Join 1,000+ professionals. Unsubscribe anytime.

Honestly? I don't know. But let's take a swing at it.

At the time of writing, there are over 20,000 cryptocurrencies listed across public databases and exchanges. By the time you finish reading this, there might be more. Most are dead. Many never lived.

So why do they keep showing up? Here are a few answers:

Because anyone can make one.

Creating a tokenA digital asset built on an existing blockchain, often representing utility or value today is easier than setting up an LLC. A few lines of code, a logo, a Medium post . . . boom, you're a "founder." EthereumA decentralized blockchain platform that enables smart contracts and decentralized applications made that possible. Hype made it contagious.

And now? You've got an exciting project, a fresh dAppAn application that operates on a blockchain instead of a centralized server, maybe even a problem no one knew existed, but you're solving it. All that's left is to build a 'community,' drop a roadmap and a whitepaperA document outlining the technical details and purpose of a blockchain project, and pray for exit liquidityLate buyers providing liquidity for insiders to sell holdings at inflated prices.

That worked in 2020.

Now it's just tech-flavored storytelling, and not a very good one most of the time.

Because tokens = equity + marketing.

A tokenA digital asset built on an existing blockchain, often representing utility or value isn't just a product. It's part funding tool, part hype engine. No VCs, no banks, no regulators, as long as it's not exchangeable or tradeable (yet). It might look like a startup IPO'ing on day one. But it's not. And forgetting that is where the trouble starts.

Because we're still early.

This is what a gold rush looks like: lots of noise, lots of nonsense, and a few gems buried deep. Not every coin needs to survive, but some already have, and others will reshape entire industries.

Because status is programmable now.

Not every tokenA digital asset built on an existing blockchain, often representing utility or value wants to be money. Some want to be clout. Access. Governance. In-game flex. We've never had programmable identity assets before. Now we do.

Because pump and dump isn't illegal (yet).

If anyone tried launching a stock IPO the way people launch crypto coins, they'd be tucked away for a long vacation — and not at the Four Seasons. Regulators are closing in, slowly expanding securities laws to cover tokenA digital asset built on an existing blockchain, often representing utility or value markets.

FBI Just Ran a Full-On Fake Token to Catch the Manipulators

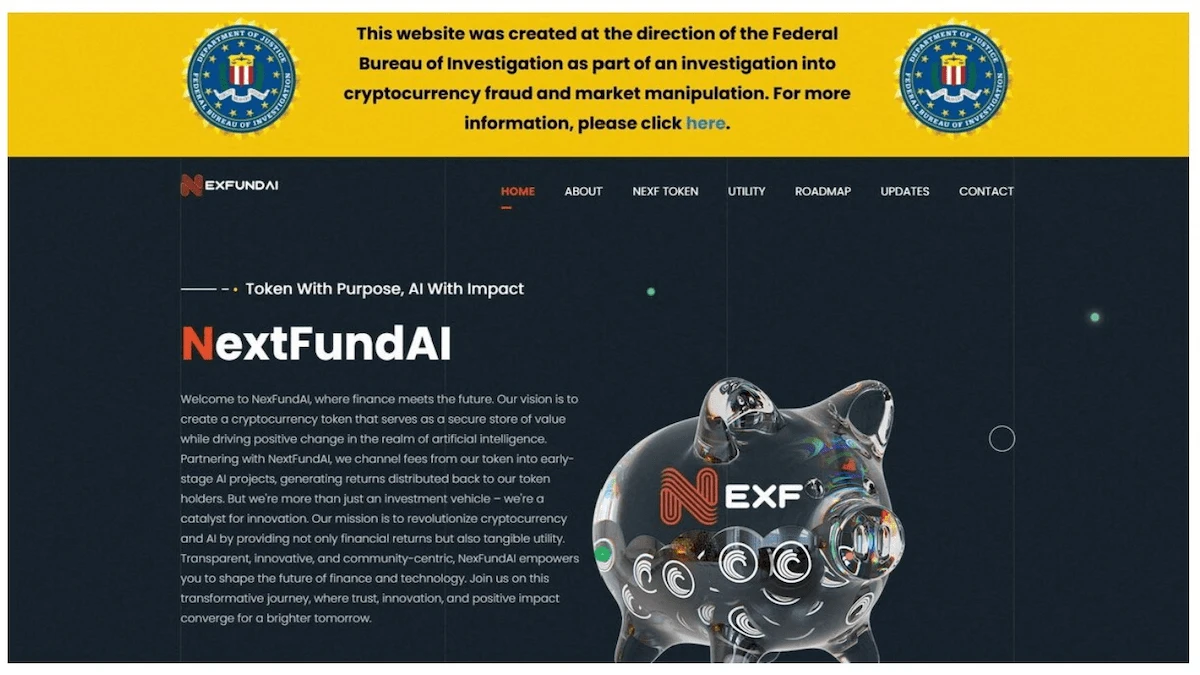

In late 2024, the FBI did something unusually crypto-native: They launched their own tokenA digital asset built on an existing blockchain, often representing utility or value - a fake project called NextFundAI - as part of an undercover sting known as Operation Token Mirrors. They built a realistic token ecosystem. Legit-looking site. Pitched it as a "security token." Then waited. Behind the scenes? Not founders. Federal agents, tracking every wash trade, every pump, every backchannel Telegram deal.

“"We want the buys to look like more buyers. That's the idea." — Saitama team, coordinating fake trades on Telegram

Over the course of the sting:

- $25 million in crypto was seized

- 18 individuals and entities were charged

- Several bots and market-making firms were shut down

- Executives from Saitama, Robo Inu, Gotbit, CLS Global, and ZM Quant were indicted or arrested

These firms weren't just juicing prices. They were engineering fake liquidityThe ease with which an asset can be bought or sold without affecting its price using wash tradingBuying and selling the same asset to create false volume appearance bots, multi-walletA tool for storing, sending, and receiving cryptocurrencies loops, and Telegram playbooks - classic pump-and-dump tactics dressed in Web3Next generation internet powered by blockchain enabling user ownership of data and digital assets clothing. These weren't amateur scammers. They were market makers.

Meanwhile, their tokens, the "decentralised" ones, were quietly being rigged to lure in retail. All while preaching innovation.

And the twist?

The day the FBI announced the sting, someone launched a copycat tokenA digital asset built on an existing blockchain, often representing utility or value, "NexFund", and rugA scam where developers abandon a project after collecting investor funds-pulled it for $127K in ETHA decentralized blockchain platform that enables smart contracts and decentralized applications. Because even when law enforcement builds a fake coin, someone still tries to front-run the grift.

This was the first criminal case targeting crypto market makers for wash tradingBuying and selling the same asset to create false volume appearance, and the DOJ didn't treat it as some new grey-area innovation. They called it what it is: securities fraud. Four defendants have already pleaded guilty. One's cooperating. This isn't theory. It's done.

“"We have to make [the other buyers] lose money in order to make profit." — A market maker, caught on record

“"We've been doing this for many clients." — CLS trader, mid-pitch as recorded

Pump-it GIFs were circulating while prices were being gamed. Literally.

How did they do it?

- Dashboards for clients to set daily wash volume targets

- Trading bots to simulate natural volume

- WalletA tool for storing, sending, and receiving cryptocurrencies networks to hide self-trades

- Coordinated order books across BitMart, LBank, XT.com

- At least 60 tokens manipulated using these tactics

This wasn't some backroom Telegram pump room. This was institutionalised deception - wrapped in dashboards and pitch decks. The FBI's response? Build a fake tokenA digital asset built on an existing blockchain, often representing utility or value. Infiltrate the system. Catch everything on record. Now the Wild West isn't so lawless anymore.

So… why are there so many?

Because crypto is part money, part internet, part human nature. And when you mix tech + capital + ego, you don't get fewer tokens. You get thousands.

Choose wisely.

Next Up

How a simple network selection mistake costs crypto users over $1 billion annually—and how to protect yourself.

If you read this far, you're already ahead of most professionals.

Join 1,000+ readers who get institutional-grade insights - clear, concise, and verifiable.

No spam. Unsubscribe anytime.

If you found this useful, please share it.

Questions or feedback? Contact us

MCMS Brief • Classification: Public • Sector: Digital Assets • Region: Global

References

- 1. U.S. Department of Justice - “Eighteen Individuals and Entities Charged in International Operation Targeting Widespread Cryptocurrency Market Manipulation” (December 15, 2024) [Link]

- 2. Reuters - “Cryptocurrency Financial Firm Plead Guilty After Novel FBI Probe” (January 21, 2025) [Link]

- 3. Exploding Topics - “Number of Cryptocurrencies” (March 10, 2025) [Link]

- 4. Statista - “Number of Crypto Coins and Tokens” (February 15, 2025) [Link]

- 5. Investopedia - “How to Make a Cryptocurrency” (November 20, 2024) [Link]

- 6. Shamlatech - “How to Create a Cryptocurrency on Ethereum” (September 15, 2024) [Link]

- 7. Variant Fund - “Tokens Versus Equity” (August 12, 2024) [Link]

- 8. Crypto for Innovation - “Utility Tokens vs Equity Tokens” (October 5, 2024) [Link]

- 9. Exolix - “How Many Cryptocurrencies Are There 2025” (January 30, 2025) [Link]

- 10. Kraken Learn - “How to Make Cryptocurrency” (July 22, 2024) [Link]

SOURCE FILES

Source Files expand the factual layer beneath each MCMS Brief — the verified data, primary reports, and legal records that make the story real.

How Many Cryptocurrencies Are There?

As of 2025, estimates vary dramatically. Some trackers list over 17,000 actively traded cryptocurrencies, while others count more than 37 million unique tokens ever created, most of them inactive or worthless. The sheer volume underscores how frictionless token creation has become — anyone with a laptop and an idea can mint an asset.

Why Do Cryptocurrencies Keep Appearing?

Creating a token is now easier than incorporating a company. Platforms like Ethereum offer ready-made standards (e.g., ERC-20) that allow anyone with minimal coding knowledge to deploy and trade tokens within minutes. Ethereum's open architecture made token creation contagious — spawning thousands of copy-projects that leverage existing standards with minimal modification. Tokens double as equity and marketing tools: a fundraising shortcut and community magnet that bypasses traditional financial regulation.

Tokens as Dual-Purpose Instruments

Cryptocurrencies function as both equity and marketing: tokens are used as fundraising vehicles, hype engines, and community-builders, allowing project founders to raise capital without the heavy regulation of traditional finance. Many tokens also serve as programmable 'status' — granting governance rights, in-game privileges, or community access. They blur traditional asset classes and blend internet culture with finance.

Pump-and-Dump Schemes & Legal Status

Regulation remains uneven, but major law-enforcement actions like the FBI's Operation Token Mirrors targeted wash-trading rings that manipulated volumes across mid-tier exchanges. $25 million seized and 18 individuals indicted in 2024–2025 signaled a clear shift: U.S. agencies now treat these schemes as securities fraud, not harmless speculation.

KEY SOURCE INDEX

- ●U.S. Department of Justice — Operation Token Mirrors: indictments and enforcement actions against crypto market manipulation

- ●Reuters — Coverage of federal investigations and regulatory developments in digital asset markets

- ●Statista — Cryptocurrency market data and global adoption metrics

- ●Investopedia — Analysis of token economics, blockchain standards, and regulatory frameworks

- ●Kraken — Industry perspective on token creation and market infrastructure

- ●Variant Fund — Institutional research on crypto financing models and tokenomics

Related Reading

- →

Coin vs. Token - What's the Difference?

Making crypto make sense: plain-language explanation of the difference between coins and tokens, with supporting references.

- →

The Future Isn't Coins - It's Tokens!

Crypto isn't dead. It's just maturing. While everyone in the West debates regulation and watches charts, real-world asset tokenization is already happening - especially in emerging markets. The use cases are real, the rails are built, and some of the smartest builders are bypassing Wall Street entirely.

Disclaimer: This content is for educational and informational purposes only. It is NOT financial, investment, or legal advice. Cryptocurrency investments carry significant risk. Always consult qualified professionals before making any investment decisions. Make Crypto Make Sense assumes no liability for any financial losses resulting from the use of this information. Full Terms