99% Of Crypto Is Noise. How to Find Real Value in 60 Seconds

99% of tokens are noise. Your edge is learning to mute them, fast. A practical 60-second filter to separate real crypto value from digital confetti.

TL;DR

- •Academic research confirms crypto's average signal-to-noise ratio is just 36% vs 90% on NYSE/NASDAQ. Most price movement is speculative flow, fragmented liquidity, and attention-driven volatility - not fundamental value signals.

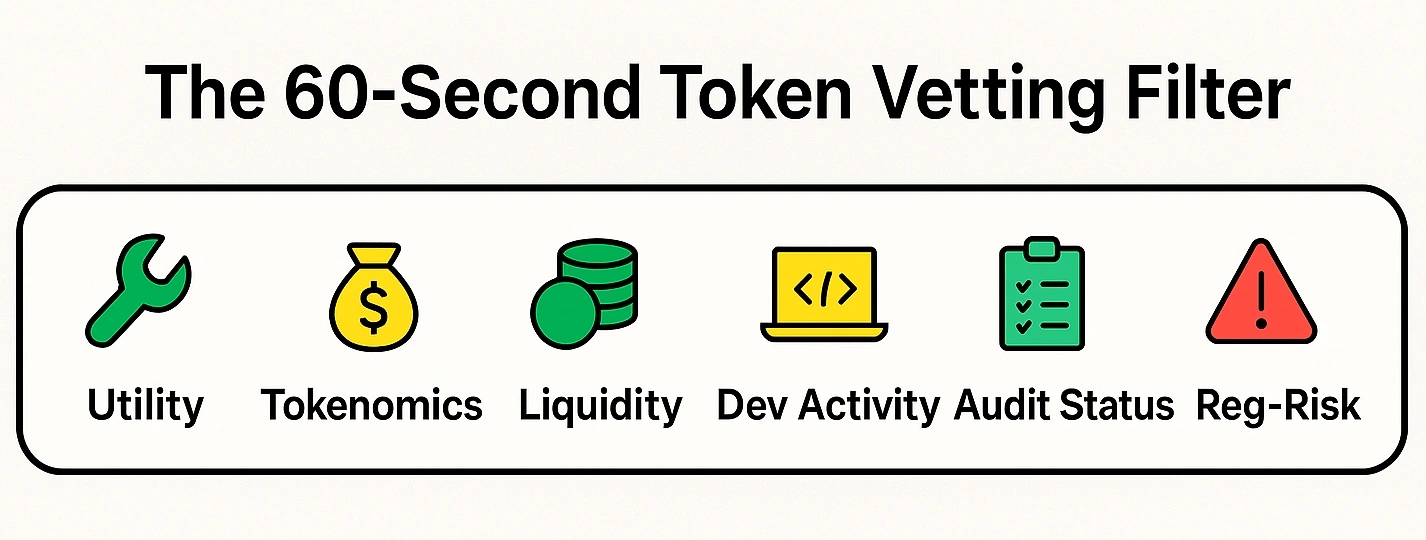

- •60-second vetting filter: (1) Real utility? (gas, staking, in-game items). (2) Hard cap + fair unlocks + real rewards? (3) Top-5 CEX listing + >$5M AMM depth? (4) GitHub updated within 30 days? (5) Full third-party audit? (6) Not in SEC crosshairs? Pass ≥5? Dive. Fail ≥2? Walk.

- •Liquidity is your emergency exit: Token must trade on Binance/Coinbase/Kraken AND hold >$5M in on-chain pools (Uniswap/Pancake/Orca). Shallow pools = you ARE the liquidity. You move the price, not the market.

- •GMX shares 30% of trading fees in ETH/esGMX - stakers paid to stay. Uniswap's UNI offers governance but zero revenue share - holders rely on hopium. If token prints endlessly, unlocks to insiders at month six, and dangles zero rewards, you're subsidizing their exit.

No agenda. No noise. Just clarity.

Get the MCMS brief - digital assets, AI, and law explained with evidence, not hype.

Join 1,000+ professionals. Unsubscribe anytime.

99% of tokens are noise. Your edge is learning to mute them, fast.

The 60-Second Token Vetting Filter

- Utility – Does the token buy real gas, secure a network, or power in-game items?

- Tokenomics – Hard cap, fair unlocks, and real rewards (fees, staking, governance) for holders?

- Liquidity – Listed on at least one Top-5 CEX and > $5 million AMM depth?

- Dev Activity – GitHub updated within 30 days; recent blog post or dev tweet?

- Audit Status – 🟢 Full third-party audit; 🟡 Partial/old audit; 🔴 None.

- Reg-Risk – 🟢 Commodity (BTC, ETH); 🟡 Utility-claim limbo; 🔴 SEC lawsuit (Ripple-style).

Pass ≥ 5? Dive in. Fail ≥ 2? Walk away.

99% of tokens are just noise

99% of tokens are background chatter, digital confetti thrown into the market to dazzle the innocent bystanders. They promise revolutions yet fund little more than speculative hopium or unattainable fairytales. Strip away the slick websites and Discord pep rallies, and you'll find no genuine utility, no sustainable cash flow, and no guardians at the gate when liquidityThe ease with which an asset can be bought or sold without affecting its price dries up.

Your job isn't to sift through that mountain of noise; it's to tune your filter so ruthlessly that the faint signal—those rare tokens with real economic purpose—practically jumps out and taps you on the shoulder.

“"99% of tokens are background chatter, digital confetti thrown into the market to dazzle the innocent bystanders."

Research confirms this intuition: academic studies have found that cryptocurrencies exhibit an average signal-to-noise ratio (SNR) of just 36%, compared to 90% on traditional exchanges like the NYSE and NASDAQ. In other words, the majority of price movement in crypto markets is noise—speculative flow, fragmented liquidityThe ease with which an asset can be bought or sold without affecting its price, and attention-driven volatility—rather than fundamental value signals.

Utility Check

A tokenA digital asset built on an existing blockchain, often representing utility or value earns its keep only if it fuels paid work that users actually need. EthereumA decentralized blockchain platform that enables smart contracts and decentralized applications's ETH is the cleanest example: every smart-contractSelf-executing code on a blockchain that automates transactions call burns a few drops of ETH as gasThe fee paid to miners or validators for processing transactions on a blockchain, tying the token's value to a real service—block-space that builders are willing to buy every day. Filecoin's FIL does the same for decentralized storage: upload data, pay FIL, miners get rewarded for keeping your files alive.

Contrast that with the parade of meme coins whose "utility" ends at a merch shop or a vague promise of future NFTs. SafeMoon, for instance, levied a 10% tax on every trade, half redistributed to holders, half burned, yet generated no external demand; value depended entirely on fresh buyers stepping in before the music stopped.

Bottom line: if the tokenA digital asset built on an existing blockchain, often representing utility or value isn't the grease that keeps a tangible engine running—gasThe fee paid to miners or validators for processing transactions on a blockchain fees, staking security, in-game transactionA transfer of value or data recorded on a blockchain, verified by network participants, and permanently added to the distributed ledger costs—then it's just a speculative air balloon waiting for someone else to holdA misspelling of 'hold,' used to mean holding onto cryptocurrency for long-term gains it when it deflates.

Tokenomics Reality Test (where most projects quietly fail)

First, check the supply tap: BitcoinThe first decentralized cryptocurrency, created in 2009 by Satoshi Nakamoto's 21 million hard-cap forces scarcity with every halvingA process in Bitcoin mining where the reward for mining new blocks is halved, reducing supply; Dogecoin, by contrast, mints ~5 billion new coins a year, value dilution baked in. Next, scrutinize distribution: Arbitrum's airdropFree distribution of cryptocurrency to wallet holders, often as a promotional tactic spread tokens across actual users, while insiders still faced a year-long cliff—reasonable.

Compare that to early SolanaA high-performance blockchain known for fast transactions and low fees, where venture unlocks dumped a tidal wave of liquidityThe ease with which an asset can be bought or sold without affecting its price just as retail piled in, kneecapping price. Finally, ask why holders stay: GMX shares 30% of trading fees in ETHA decentralized blockchain platform that enables smart contracts and decentralized applications and esGMX, so stakers are paid to stick around; Uniswap's UNI, meanwhile, offers lofty governance rights but no revenue share, so holders must rely on hopium that "one day" value accrues.

“"If a tokenA digital asset built on an existing blockchain, often representing utility or value prints endlessly, releases most of its stack to insiders at month six, and dangles zero real rewards, you're not investing—you're subsidizing their exit."

If a tokenA digital asset built on an existing blockchain, often representing utility or value prints endlessly, releases most of its stack to insiders at month six, and dangles zero real rewards, you're not investing, you're subsidizing their exit.

Liquidity Look: your emergency exit plan in one line of code

Before you even glance at price charts, ask: Can I sell without bleeding out? Real liquidity is a two-part test: (1) the token trades on at least one top-tier CEX—Binance, Coinbase, Kraken, OKX, Bybit—and (2) its on-chain pools on Uniswap, Pancake, or Orca hold more than $5 million in depth.

Miss either and you are the liquidityThe ease with which an asset can be bought or sold without affecting its price; shallow pool = you move the price, not the market.

Those pools are powered by an Automated Market MakerAlgorithmic trading model using liquidity pools instead of order books (AMM), a vending machine of smart-contractSelf-executing code on a blockchain that automates transactions math. Users deposit two assets, say ETHA decentralized blockchain platform that enables smart contracts and decentralized applications and USDCA fully-reserved stablecoin pegged 1:1 to the US Dollar, issued by Circle and backed by regulated financial institutions; the algorithm quotes a swap price based on the ratio inside, then automatically rebalances after every trade.

Feed it ETHA decentralized blockchain platform that enables smart contracts and decentralized applications, out pops USDCA fully-reserved stablecoin pegged 1:1 to the US Dollar, issued by Circle and backed by regulated financial institutions, price nudges up to reflect the new balance. Deep pools act like Costco: buy or sell in size, and the shelf never looks bare. Shallow pools are a corner kiosk—one big order and the price spikes, or worse, you discover there's no water left when the fire starts. LiquidityThe ease with which an asset can be bought or sold without affecting its price isn't a vanity metric; it's the line between cashing out and subsidizing someone else's exit.

Dev Heartbeat: check the pulse before you wire the money

“"I was reviewing a client's tokenA digital asset built on an existing blockchain, often representing utility or value portfolio when I realized: 47 of the 50 tokens had zero dev activity in six months. They owned digital ghosts."

A token's main GitHub repository tells you everything in one glance: "Last updated … days ago." An update this week means builders still have their hands on the code, good. Six-month silence? That's a vacant construction site waiting for squatters. For larger projects, platforms like CryptoMiso and Cryptometheus rank coins by commit frequency, giving you instant visibility into which dev teams are shipping versus which ones packed up and left. For smaller tokens (the mid-caps and ICO leftovers cluttering retail portfolios) you'll need to dig manually: pull up the project's GitHub link (usually in their whitepaper or website footer), check the commit history, and cross-reference with dev blogs or recent tweets. If the code is dark, the Medium posts have gone silent, and the last X update was a generic "WAGMI" six months ago, you're looking at abandoned infrastructure. Expect stalled features, unpatched bugs, and a team already hunting the next gig: the exact cocktail that drains liquidity and invites exploits. Think of walking past a trading desk at noon and finding every screen black: phones quiet, no orders buzzing. Something's off, keep walking.

Smart-Contract Audit: your red-flag detector in one glance

First question: Was the code audited, and by whom?

🟢 A green light means a full, independent review by a heavyweight firm—Trail of Bits, Quantstamp, CertiK. Professionals tear the contractSelf-executing code on a blockchain that automates transactions apart, patch or disclose flaws, and publish a report. Not a guarantee, but it slashes risk from "unknown" to "manageable bruises."

🟡 Yellow is a partial or community skim—maybe the audit's 18 months old, maybe coverage was thin. Something was checked, but freshness and depth are questionable; read the report, tread carefully.

🔴 Red is "self-audited" or simply unaudited: no outside eyes, no accountability. At that point every line of code is a potential drainpipe, and technical risk jumps from bruises to atomic.

Treat the traffic lights literally—green to proceed, yellow to interrogate, red to invest only what you can watch burn.

Reg-Risk Meter: Is it a security in the SEC's crosshairs?

Picture a simple traffic-light bar:

- Green – Commodity land. Bitcoin, ETH-post-Merge. Enforcement risk ≈ background noise.

- Yellow – Regulatory fog. "Utility token" claims, no formal action yet. Monitor the docket.

- Red – Ripple-class lawsuit, subpoenas flying. At this point you're wagering on lawyers, not code; any win comes after discovery and a check to your barrister.

If the meter is flashing red, walk—or price in the legal fight.

Mini Takeaway

Pass at least 5 of 6 checks? Keep digging.

Fail 2 or more? Walk away!

Next Up

Forget finance for a second. Forget treasuries and condos. Let's talk about you, me, and the weird little moments in life that actually matter. TokenizationConverting real-world assets into digital tokens on a blockchain isn't just about money, it's about proof, privacy, and power.

If you read this far, you're already ahead of most professionals.

Join 1,000+ readers who get institutional-grade insights - clear, concise, and verifiable.

No spam. Unsubscribe anytime.

If you found this useful, please share it.

Questions or feedback? Contact us

MCMS Brief • Classification: Public • Sector: Digital Assets • Region: Global

References

- 1. Journal of Empirical Finance - “Nothing but noise? Price discovery across cryptocurrency exchanges” (June 17, 2021) [Link]

- 2. Financial Stability Board & International Monetary Fund - “Policies for Crypto-Assets: IMF-FSB Synthesis Paper” (September 7, 2023) [Link]

- 3. Financial Stability Board - “Global Crypto-Asset Policy Implementation Roadmap” (October 22, 2024) [Link]

- 4. European Central Bank - “Just another crypto boom? Mind the blind spots” (May 20, 2025) [Link]

- 5. U.S. Securities and Exchange Commission - “SEC Crypto Task Force and Project Crypto Initiative” (January 1, 2025) [Link]

- 6. European Securities and Markets Authority - “Markets in Crypto-Assets Regulation (MiCA)” (December 30, 2024) [Link]

- 7. Monetary Authority of Singapore - “Singapore Crypto Licensing Requirements” (June 30, 2025) [Link]

- 8. Federal Reserve Bank of Boston & MIT - “Project Hamilton: High-Performance CBDC Research” (February 3, 2022) [Link]

- 9. ETH Zurich Blockchain & DLT Group - “Distributed Ledger Technology Systems: A Conceptual Framework” (January 1, 2019) [Link]

- 10. Bank for International Settlements - Basel Committee - “Prudential Treatment of Cryptoasset Exposures (Basel Committee Standard)” (August 1, 2025) [Link]

- 11. Satoshi Nakamoto - “Bitcoin: A Peer-to-Peer Electronic Cash System” (October 31, 2008) [Link]

- 12. Ontario Securities Commission - “The Ecology of Automated Market Makers” (July 11, 2024) [Link]

- 13. McKinsey & Company - “From Ripples to Waves: The Transformational Power of Tokenizing Assets” (January 1, 2025) [Link]

- 14. Boston Consulting Group - “Tokenized Funds: The Third Revolution in Asset Management” (October 29, 2024) [Link]

- 15. DataWallet Industry Research - “Best Smart Contract Auditing Companies: Security Analysis” (January 1, 2025) [Link]

- 16. IEEE/ACM Conference on Mining Software Repositories - “Cryptocurrency Open-Source Development: Mining Software Repositories” (January 1, 2019) [Link]

- 17. BlockApps Industry Research - “Token Unlock Schedules and Market Impact Analysis” (January 1, 2025) [Link]

SOURCE FILES

Source Files expand the factual layer beneath each MCMS Brief — the verified data, primary reports, and legal records that make the story real.

Signal-to-Noise Ratio: Academic Validation of Crypto Market Quality

The article's central claim that '99% of tokens are noise' is empirically validated by academic research published in the Journal of Empirical Finance. Dimpfl & Peter's study analyzing price discovery across cryptocurrency exchanges found that cryptocurrencies exhibit an average signal-to-noise ratio (SNR) of just 36%, compared to approximately 90% on traditional exchanges like NYSE and NASDAQ. This quantifies what the article describes as 'digital confetti'—the majority of price movements in crypto markets reflect speculative flow, fragmented liquidity, and attention-driven volatility rather than fundamental information discovery. The European Central Bank's May 2025 financial stability report characterizes crypto markets as exhibiting 'speculative cycles and overvaluation driven by hype and lack of fundamentals,' directly supporting the article's warning about tokens that 'promise revolutions yet fund little more than speculative hopium.' The IMF-FSB Synthesis Paper on crypto-asset policies emphasizes that comprehensive regulatory responses are necessary because most crypto-assets lack genuine utility and sustainable cash flows. The Financial Stability Board's October 2024 global policy roadmap notes that 93% of FSB member jurisdictions plan to develop or revise frameworks specifically to address risks from speculative tokens without economic purpose—validating the article's 60-second filter approach as necessary due diligence in an objectively noisy market environment.

Utility Validation and Tokenomics: Technical Standards and Economic Design

The article's 'Utility Check' criterion—whether tokens 'fuel paid work that users actually need'—aligns with technical standards established in foundational blockchain literature. Bitcoin's whitepaper by Satoshi Nakamoto describes the Proof-of-Work consensus mechanism and economic incentive structure creating genuine utility through security provision. The article's example of 'Ethereum's ETH burning gas for every smart-contract call' references this principle: tokens must serve essential network functions rather than purely speculative purposes. ETH Zurich's Blockchain & DLT research group published comprehensive taxonomies classifying over 1,000 distributed ledger systems, identifying supply mechanisms and distribution schedules as critical design parameters affecting long-term sustainability. This academic framework validates the article's 'Tokenomics Reality Test' examining hard caps (Bitcoin's 21 million), distribution schedules (Arbitrum vs early Solana unlocks), and holder incentives (GMX fee sharing vs Uniswap governance-only). BlockApps industry research on token unlock schedules documents that releases exceeding 1% of circulating supply typically trigger notable price movements, with approximately one-third of tokens remaining locked with insiders—directly supporting the article's warning: 'If a token prints endlessly, releases most of its stack to insiders at month six, and dangles zero real rewards, you're subsidizing their exit.' The Basel Committee's Cryptoasset Standard, developed under BIS oversight, requires banks to apply rigorous risk assessments explicitly addressing tokenomics-related risks including supply inflation and insider distribution patterns, confirming institutional recognition of these design flaws.

Liquidity Infrastructure: Automated Market Makers and Institutional Adoption Thresholds

The article's liquidity criterion—tokens must trade on top-tier centralized exchanges AND maintain >$5 million in on-chain automated market maker (AMM) pool depth—reflects institutional research on market microstructure. The Ontario Securities Commission's comprehensive report on 'The Ecology of Automated Market Makers' defines Total Value Locked (TVL) as a key liquidity measure, noting that deeper pools reduce arbitrage opportunities and improve price discovery efficiency. The article's warning that 'shallow pools = you ARE the liquidity; you move the price, not the market' directly references this OSC analysis. McKinsey's tokenization research emphasizes that institutional capital adoption requires robust secondary market liquidity with minimum depth thresholds varying by asset class. Their analysis projects tokenized market capitalization could reach $2 trillion by 2030 (excluding stablecoins), but only if liquidity infrastructure reaches critical mass. Boston Consulting Group's report on tokenized funds similarly identifies sustained daily trading volume exceeding 0.5% of market capitalization as the threshold attracting institutional participation—validating why the article specifies >$5 million depth rather than arbitrary lower thresholds. The article's AMM explanation—'Users deposit two assets, say ETH and USDC; the algorithm quotes a swap price based on the ratio inside, then automatically rebalances after every trade'—describes the constant product formula (x × y = k) central to Uniswap and similar protocols. MIT's Project Hamilton collaboration with the Boston Federal Reserve demonstrated high-performance transaction processing (1.7 million TPS) establishing technical benchmarks for digital currency liquidity infrastructure that institutional adoption requires.

Development Activity and Smart Contract Security: Technical Due Diligence Standards

The article's 'Dev Heartbeat' criterion—requiring GitHub updates within 30 days and monitoring commit frequency—is validated by empirical research analyzing over 100 million open-source crypto commits. A panel data study published in IEEE/ACM Mining Software Repositories Conference tracked 236 cryptocurrencies over multiple years, finding that projects with fewer than 10 active contributors in the preceding 90 days faced substantially elevated abandonment risk. The top 200 blockchain projects collectively receive over 200,000 combined commits annually (500+ commits per day), establishing the baseline activity level the article references when warning: 'Six-month silence? That's a vacant construction site waiting for squatters.' The article's traffic-light smart contract audit framework—🟢 full third-party audit (Trail of Bits, CertiK, OpenZeppelin), 🟡 partial/old audit, 🔴 none—reflects industry security standards. DataWallet industry research documents that audited projects experience significantly fewer exploits: CertiK has secured over $558 billion in assets with $351 million in losses across audited projects (0.06% loss rate), while OpenZeppelin secured $50 billion with only $6.28 million in losses (0.01% loss rate). Trail of Bits reports just $3.3 million in losses across its client base, demonstrating the risk reduction from professional security review. The article's warning that unaudited code means 'every line is a potential drainpipe, and technical risk jumps from bruises to atomic' is technically precise. Smart contracts are immutable once deployed; bugs cannot be patched without complex upgrade mechanisms that themselves introduce centralization risks. Third-party audits employ formal verification, fuzz testing, and manual code review to identify vulnerabilities before deployment—the 'red-flag detector' the article characterizes as essential due diligence.

Regulatory Risk Assessment: Global Framework Fragmentation and Compliance Requirements

The article's 'Reg-Risk Meter' traffic-light system—🟢 commodity status (Bitcoin, ETH), 🟡 utility-token limbo, 🔴 active SEC litigation—reflects the fragmented global regulatory landscape documented by international institutions. The U.S. Securities and Exchange Commission's Project Crypto initiative launched in 2025 aims to establish clear frameworks distinguishing securities from commodities, providing disclosure requirements for crypto ETPs. This represents regulatory evolution rather than clarity: the article's warning that yellow-zone tokens require 'monitoring the docket' remains accurate given ongoing enforcement uncertainty. The European Securities and Markets Authority's Markets in Crypto-Assets (MiCA) regulation became fully applicable across all EU member states on December 30, 2024, creating harmonized standards for crypto-assets, asset-referenced tokens (ART), and e-money tokens (EMT). MiCA distinguishes crypto-assets qualifying as financial instruments (subject to MiFID II) from those regulated exclusively under MiCA—but this EU framework diverges from U.S., UK, and Asian approaches, creating the cross-border complexity the article references. Singapore's Monetary Authority (MAS) tightened crypto licensing requirements effective June 30, 2025, mandating that all digital token service providers—including those serving only overseas markets—obtain licenses or cease operations. The IMF-FSB Synthesis Paper notes that 93% of FSB member jurisdictions have plans to develop or revise crypto-asset frameworks, with 62% expecting alignment by 2025, yet cross-border regulatory fragmentation remains a challenge. The article's advice to 'walk—or price in the legal fight' when facing red-zone enforcement reflects this reality: regulatory classification varies by jurisdiction, and tokens in litigation face years of uncertainty regardless of technical merit.

KEY SOURCE INDEX

- ●Journal of Empirical Finance — Academic journal publishing peer-reviewed research documenting cryptocurrency signal-to-noise ratio of 36% vs 90% on traditional exchanges

- ●Financial Stability Board (FSB) — International body coordinating financial regulation across 93% of member jurisdictions developing crypto-asset frameworks by 2025

- ●U.S. Securities and Exchange Commission — Federal regulator's Project Crypto initiative establishing disclosure requirements and enforcement frameworks for digital assets

- ●European Securities and Markets Authority (ESMA) — EU regulatory authority implementing Markets in Crypto-Assets (MiCA) regulation harmonizing standards across member states since Dec 2024

- ●Monetary Authority of Singapore (MAS) — Singapore's financial regulator implementing June 2025 mandatory licensing for all digital token service providers including offshore operators

- ●Bank for International Settlements (BIS) — Central bank institution developing Basel Committee Cryptoasset Standard requiring rigorous bank risk assessments of crypto exposures

- ●MIT Digital Currency Initiative — Massachusetts Institute of Technology research center collaborating with Boston Fed on Project Hamilton CBDC achieving 1.7M TPS benchmarks

- ●McKinsey & Company — Global consulting firm projecting tokenized market capitalization reaching $2 trillion by 2030 contingent on institutional liquidity infrastructure

- ●Ontario Securities Commission — Canadian regulatory authority publishing comprehensive research on automated market maker ecology and total value locked metrics

Related Reading

- →

Coin vs. Token - What's the Difference?

Making crypto make sense: plain-language explanation of the difference between coins and tokens, with supporting references.

- →

Who's Holding My Money? The Ugly Truth No One Tells You

You've bought crypto. But do you actually own it? This is the issue they don't explain: wallets, keys, and who's really in control.

- →

Who Spent My Money?

We used to worry about hackers. Now we have to worry about our own software. Because the next time money leaves your wallet, you might not be the one who sent it. Welcome to agent commerce: Where AI doesn't just recommend, it executes.

Disclaimer: This content is for educational and informational purposes only. It is NOT financial, investment, or legal advice. Cryptocurrency investments carry significant risk. Always consult qualified professionals before making any investment decisions. Make Crypto Make Sense assumes no liability for any financial losses resulting from the use of this information. Full Terms